Partnered with:

Partnered with:

Your CredCall.com membership provides you with 24/7/365 day credit file monitoring from the three major credit bureaus; Experian, TransUnion, and Equifax. An important part of having a healthy financial future is to keep track of your credit and catch any errors or issues as soon as they happen. This is important before you need to use your credit to buy a home, car or anything that depends on your credit history.

At CredCall we’re here to show you that you don’t have to settle, and that knowing where your credit stands is a lot easier than you may think. Our top-performing credit monitoring will help you stay informed of what’s on your credit profiles. We know it’s important to watch for changes in your credit scores, but we also know you’re a busy person. Let us keep you up-to-date with our credit monitoring service with any changes we see; whether it’s a credit inquiry, a suspicious charge, or fraudulent activity.

Because you shouldn’t have to be perfect to have a great credit score.

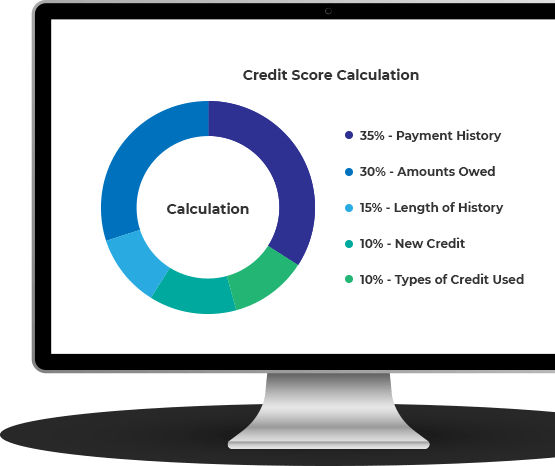

Ever wonder how your credit score is calculated?

It all stems from your credit report.

Your credit report is a complete summary of your credit history. To most people, this means the more you pay your bills on time, the better your score will be. But there’s a lot more to it than just that.

How often do you pay your bills on time? Too many late payments will negatively impact your credit score.

How much debt do you currently have? The lower the debt, the better your score.

How long is your credit history? When you have a lengthy timeline of responsible credit use under your belt, that will have a positive impact on your credit score.

Have you opened any new lines of credit lately? Too many applications will make you seem desperate and can have a negative impact on your score.

Do you have more than one credit line? Having experience with other types of credit (auto loans, credit cards, student loans, etc.) can help your credit score.

Most people also tend to pay more attention to the positive marks, and less attention to the negative marks. Here’s just a few of the negative marks you’ll need to watch out for:

Late Payments

Collections

Foreclosures

Errors

Notice that last one? Yes, credit reporting errors can take place, and yes, they can exist on your credit report for long periods of time. In fact, over 21 percent of consumers have reported discovering errors on their credit reports, and over 68 percent of people end up destroying their credit scores before the age of 30 (due to negative marks or other means). Left unchecked, these errors can have a serious negative impact on your credit score. And to make matters worse, most people don’t even realize these errors exist until after the damage has been done.

Why let unchecked negative marks and errors wreak havoc on your credit report?

And more importantly, why wait until after there’s already been damage to monitor your credit scores?

Round- the-clock monitoring is possible. And that’s where we come in.

Our credit isn’t something most people think about everyday. But, when you need to use it, it suddenly becomes very important.

Anytime you go to apply for a loan, whether it’s for a house, automobile, or credit card, odds are your credit will be pulled. We want you to be informed of where your credit stands before the person running your credit does. Knowing if your credit files are accurate can be critical when trying to get approved, and also aids in locking in a low interest rate for your loan.

We want you to feel confident knowing not only what your scores are, but also anytime something affects those scores. Our credit monitoring means we keep an eye out for changes that may impact your scores. This means you can go about your everyday life knowing we’ve got your back.

A healthier credit report can mean better credit scores. And better credit scores may mean more financial freedom. Credcall’s credit monitoring assists you in knowing those scores and reports.

Knowing where your credit scores are could help you get the lowest interest rates on credit cards, loans, and even car insurance. Approvals for apartments and homes becomes easier. You’ll have higher negotiation power, you can avoid having to pay security deposits, and (let’s be honest) no one will be able to take away your bragging rights.

So now the only question you need to ask yourself is this: What are you waiting for? We’re ready to hook you up with the gold standard in credit monitoring products. It’s time to get the tools you deserve.